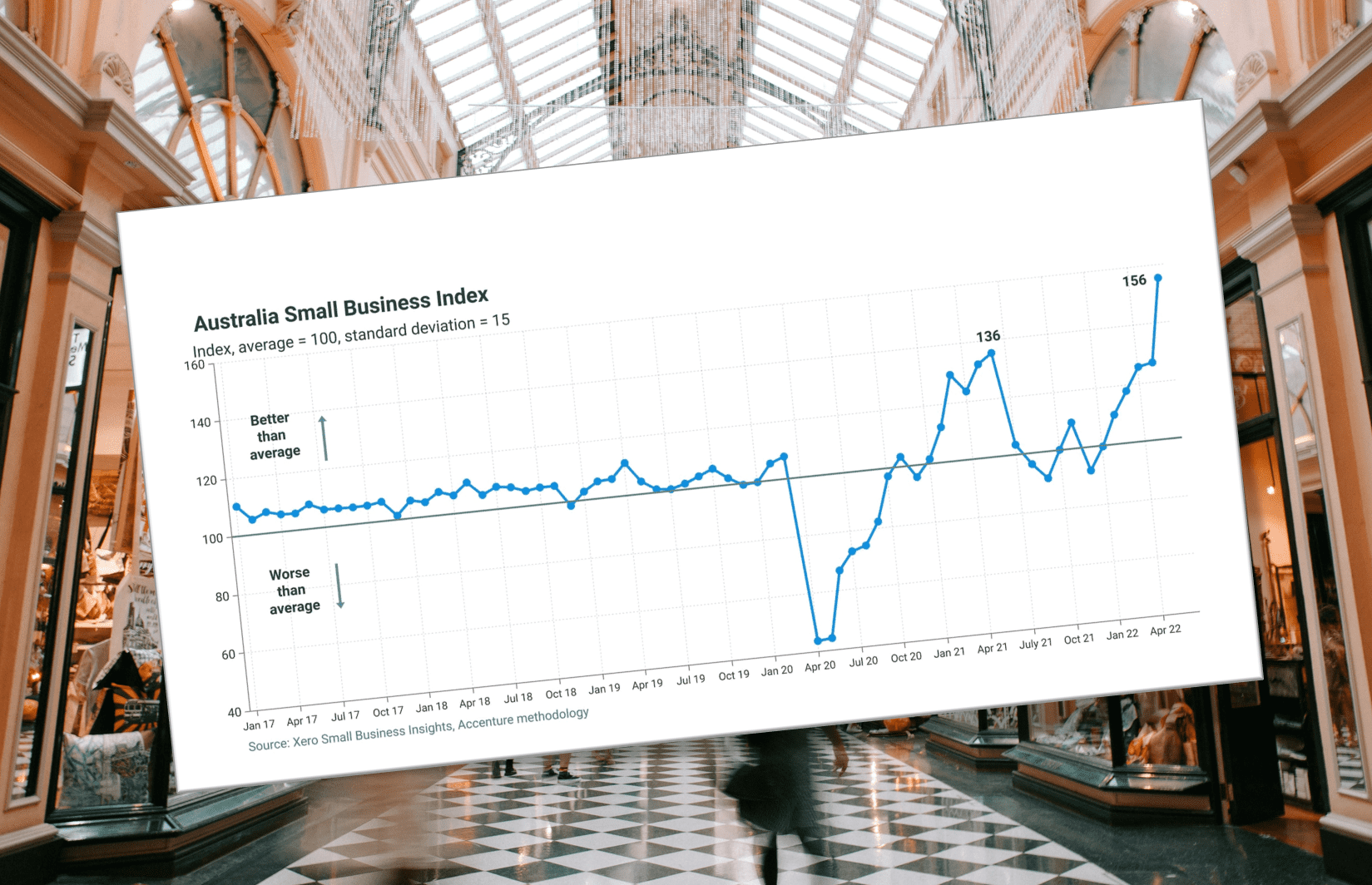

In recent years, small businesses have faced many challenges. These include Covid-19, international conflict and natural disasters. Now, with inflation on the rise, small businesses face more stress. Yet, according to the Australian Small Business Index, small business continue to show resilience under pressure.

Australian Small Business Index: Covid-19 Impact

The Australian Small Business Index depicts month to month changes in the overall performance of Australian small businesses. Between April 2017 and March 2020, the index showed that small businesses actually performed consistently above average. The stability of these results are likely in part thanks to government support made available to small businesses during the Covid lockdowns. Further, economy-stimulating vouchers, such as the NSW Dine and Discover vouchers helped keep businesses afloat.

A drastic decline occurred in April 2020, and many businesses were forced into a hibernation period, making significant changes to capital spending and staffing.

“While it is clear that COVID-19 represents the most significant threat to the economy, some regions and industries have also been acutely impacted by other factors, such as bushfires and drought, which have had a concentrated impact in some parts of NSW”, said Business NSW Chief Executive Stephen Cartwright, April 8 2020.*

Since then, the index shows an overall recovery, even performing well above the average at times. However, there is a pattern of instability, with larger, more frequent fluctuations.

Xero summarises four key areas that are impacting small businesses.

Jobs

After several months of falling job rates, there is now a 2% rise in jobs. This is the largest rise since November 2021. Education and training, wholesale trade and agriculture continue to record declines.

“The jobs result is hugely positive, and fantastic to see a rebuilding in recent months after a soft start to 2022”, said Louise Southall. Xero Economist.

Wages

This month, all industries experienced slowed wage growth. Wages grew 3.4% year on year in June 2022, down from a record high of 4.2% in April. This result is surprising in a climate where there is a low unemployment rate, and healthy competition for staff. In contrast, United Kingdom and New Zealand small businesses enjoy at least 5% wage growth this year.

Delays in payments impact small business

In May, small businesses had to wait longer for payments. Wait times rising by 0.8 days to 23.7 days, being the longest wait time since September 2020. However, in June, the average wait time for small businesses to be paid fell by 3.5 days to 20.1 days. This drastic fall is likely due to it being the end of the financial year.

Cautious optimism for Australian small businesses

Joseph Lyons, Managing Director Australia and Asia, Xero, said, “The time it takes for small businesses to get paid can massively impact cash flow, so it’s encouraging to see a drop in payment times. Although this is a seasonal impact, there is still reason to be cautiously optimistic – after all, healthier cash flow equals stronger small business performance. Despite inflation impacting Australian household spending, sales growth has continued at a double-digit pace.”

Despite the resilience of Australian small businesses to date, many are bracing themselves for tough times ahead. They are focusing on ways to recession-proof their business.

Sales

Sales rose by 10.6% year on year, however, this figure is likely in part to rising prices rather than higher sales volumes. Administrative and support services saw the largest increase, the arts and recreation services also spiking after suffering during covid lockdowns. Discretionary spending-based industries saw the slowest growth, indicating a lack of consumer confidence, with further pressure from rising interest rates and a reduction in disposable income.

Small businesses relying on discretionary spending will be the first to be impacted by inflation. Not only will small businesses be impacted by customer spending patterns, but they will also be one of sectors most likely to struggle with managing wage growth and increasing costs of materials and outgoings.

“Looking ahead, the main risk remains around the impact of inflation on small businesses, especially those in industries dependent on discretionary spending, and if wages growth continues to lag behind price rises”. (Xero Small Businesses Index Australia Monthly Update, May 2022)

Southall said, “The sales results show that Australian small businesses are continuing to sell more goods and services than they did a year ago, despite customers facing cost of living pressures. It’s a testament to how our small business economy has continued to show resilience through the current inflation crisis.